Understanding Import Duty on Shoes

Hello, this is Richard Jant from the Mescot Footwear , and today, I want to delve deep into the world of footwear tariffs and duty regulations. Importing shoes into the a country, say United States, involves navigating various considerations, including import duty. While it may seem simple to ship shoes overseas, there are essential aspects to understand. We’ll guide you through this intricate journey, covering everything from HTS codes to the factors influencing duty rates.

Demystifying the Harmonized Tariff Schedule (HTS)

The Harmonized Tariff Schedule (HTS) might seem like an intimidating labyrinth of numbers and codes. However, it’s essentially a comprehensive system used globally to classify and identify products for international trade. In the context of shoes, the HTS plays a crucial role. It outlines the duty rates for different types of products, including footwear.

Let’s simplify this. The HTS code is like a universal language that customs officials, importers, and exporters use to categorize products. These codes consist of ten digits, and each digit represents a specific aspect of the product’s classification. Importers must correctly assign an HTS code to their shoes to determine the applicable import duty.

The Duty Declaration Form and Material Classification

As you embark on the journey of import duty on shoes, you’ll encounter the duty declaration form. This form is the gateway to understanding the materials used in your shoes, which significantly impacts the classification and, consequently, the import duty rate. Different materials, such as leather, synthetic, or rubber/plastic, attract varying duty rates.

Demystifying Duty Rates for Shoes

Now, let’s shed light on a common question: Why do different pairs of shoes have distinct duty rates? Duty rates for shoes can vary based on several factors, including the materials used, their intended function, gender specifications, size, construction, and even their declared value.

Classifying Your Shoes Accurately

Classifying your shoes correctly is crucial because it determines the import duty rate and, ultimately, your product’s landed price. This process involves referencing the HTS, which is an extensive book. However, don’t be overwhelmed; we will simplify the process for you. Importers only need to be aware of a few specific HTS codes that apply to common shoe types.

Let’s take a practical example: men’s golf shoes. If you’re importing these shoes, you’d assign the HTS code 6402.19.05.30, which signifies that these are men’s golf shoes imported at a 6% duty rate. Understanding how to classify your shoes accurately is fundamental to the importing process.

Shipping Your Shoes: Container Considerations

After completing your shoe production run, the next step is to transport them to the United States. Shoes are typically packed into ocean freight containers, which come in various sizes. The standard container size is 40 feet by 8 feet by 8 feet, capable of holding approximately 5000 pairs of shoes. It’s important to consider container size, as it impacts shipping costs and logistics.

Choosing Between FCL and LCL

When deciding on shipping logistics, you’ll face a choice between a Full Container Load (FCL) and Less than Container Load (LCL). Opting for a Full Container Load is often advisable. Why? Because it offers cost-effectiveness, faster shipping, and better protection for your merchandise.

Freight Forwarding: Managing Shipping Logistics

Once your shoes are packed into containers, they are transported to the freight harbor, usually by a freight forwarder or the factory’s appointed forwarder. These professionals play a crucial role in handling shipping arrangements, export/import documentation, and passing the necessary shipping documents to customs officials in both the exporting and importing countries.

The freight forwarder also schedules your container to align with the vessel’s departure, ensuring an efficient transition from China to the United States. This coordination is essential, as the ocean shipping duration from China to the USA typically spans 15 to 25 days.

Country-Specific Import Duty on Shoes

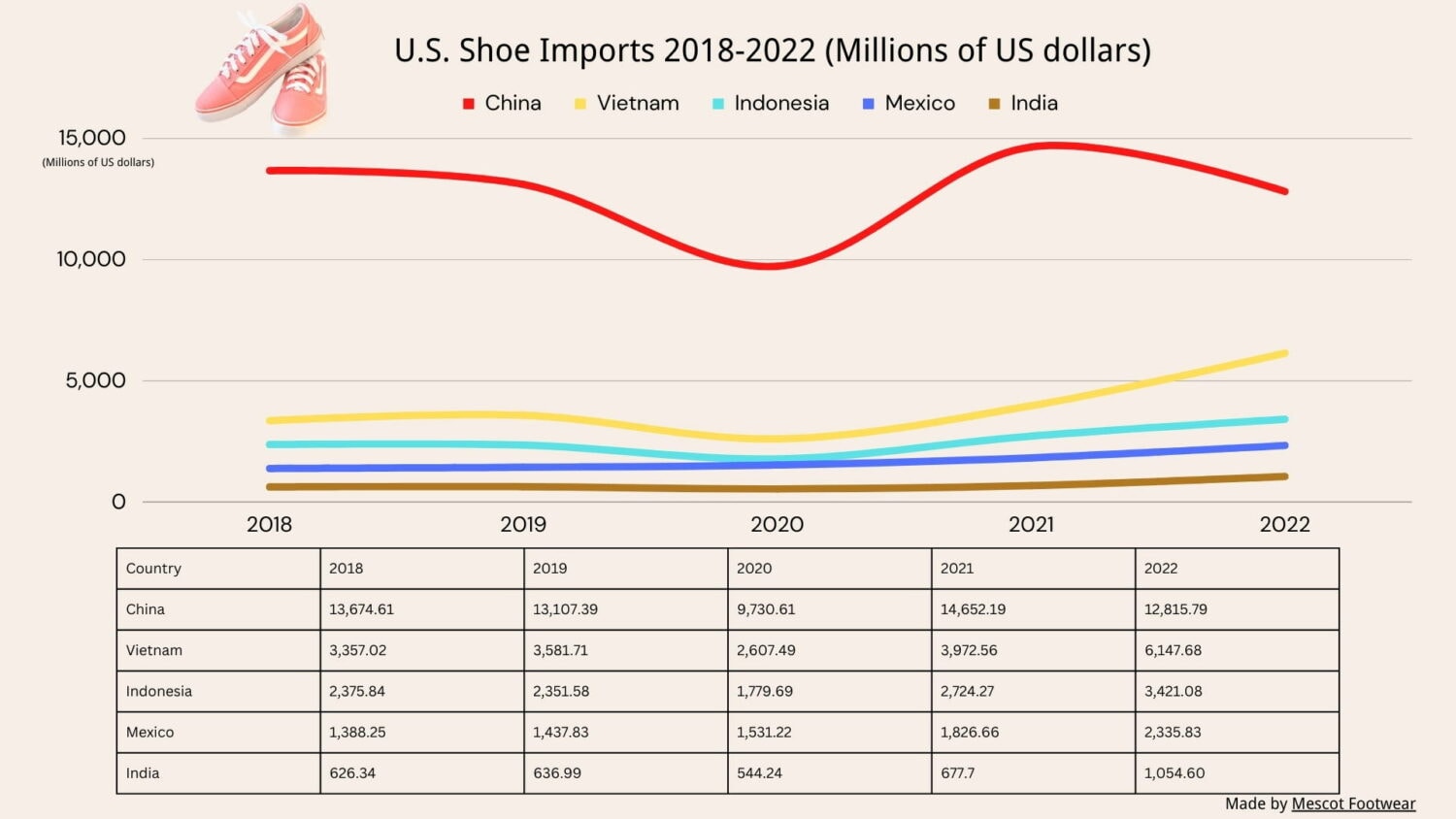

While we primarily import shoes from China to the USA, it’s important to note that import duty regulations can vary significantly depending on the country of origin and the destination country. Each importing country may have its unique set of duties and regulations for footwear.

Calculating Shipping Costs

Understanding the cost structure of your shoe importation is crucial. Shipping costs can be calculated by dividing container rates, document fees, and inland transport by the number of shoes in the container. For example, if you’re shipping a full container load of 500 pairs in a 40-foot container from China to the West coast of the USA, it would cost approximately $0.75 per pair.

HTS Code Reference for Common Shoe Types

Let’s simplify the process of assigning HTS codes to your shoes. While the HTS is indeed extensive, there are only a few HTS codes to know for common shoe types. Here’s a brief guide:

Sneakers and Athletic Shoes: These typically fall under HTS code 6404.11, with duty rates varying based on material composition.

Dress Shoes: Men’s leather dress shoes, for instance, might be categorized under HTS code 6403.99, subject to duty rates associated with leather goods.

Boots: Depending on factors like material and usage, boots can fall under various HTS codes, each with its specific duty rate.

Understanding the Peculiar Rules

One intriguing aspect of HTS classification is the occasional presence of rules that might seem peculiar. For example, some products, like snowboarding boots, may enjoy zero duty due to influential connections or special trade agreements. These anomalies highlight the importance of knowing the intricacies of the HTS to optimize your import strategy.

Factors Influencing Duty Rates

Duty rates are influenced by several factors:

Material: The primary material used in the shoe (typically comprising over 51% of the product) heavily influences classification and duty rates.

Function: The intended purpose of the shoe, such as athletic, casual, or formal wear, can impact duty rates.

Gender and Size: Some shoes are specifically classified based on gender (men’s, women’s, or children’s) and size.

Construction: The way the shoe is constructed, whether welted, cemented, or vulcanized, can affect classification.

Declared Value: The declared value of the shoes also plays a role in determining duty rates.

Consultation for Duty Efficiency

For shoe designers, developers, and product managers, understanding import duty on shoes is not just a technicality—it’s a business imperative. Small adjustments in shoe pricing can significantly impact duty payments, affecting your bottom line. Therefore, it’s advisable to consider consulting with an import classification specialist.

These specialists can assist you in optimizing your product line, designing duty-efficient shoes, and minimizing duty payments. This not only ensures compliance with import regulations but also provides greater value to your customers by offering competitive prices and high-quality footwear.

Are you looking for a good shoe manufacturer? I’ll share with you how to quickly identify a good shoe supplier. Click here to know: 8 Tips to Quickly Identify a Good Shoe Supplier