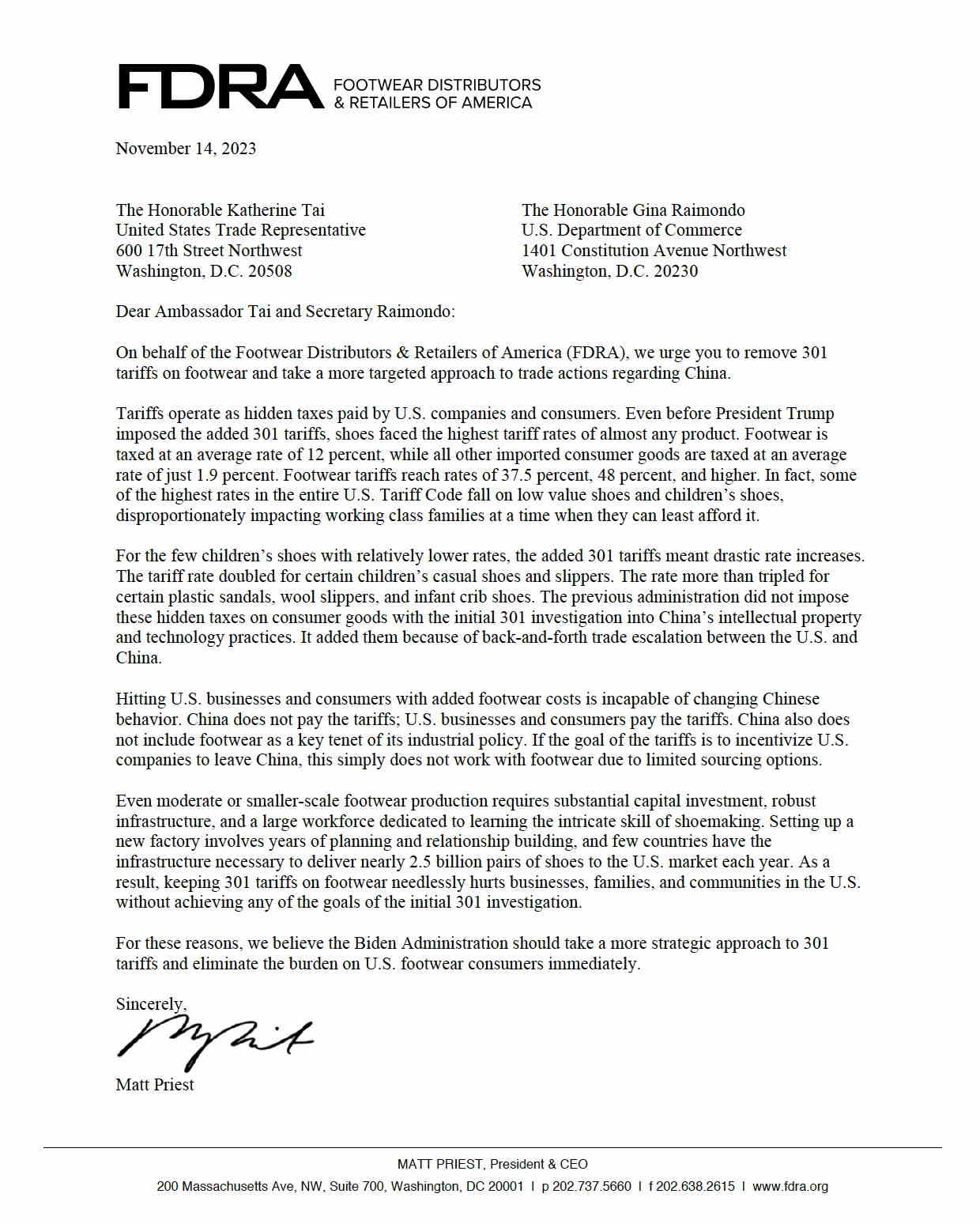

In a significant appeal for a reevaluation of trade policies, the Footwear Distributors & Retailers of America (FDRA) recently sent a letter to US Trade Representative Katherine Tai and US Secretary of Commerce Gina Raimondo on November 15, 2023.

The letter calls for a reconsideration of the Section 301 Tariffs on Chinese Footwear Imports, emphasizing their adverse effects on American businesses and consumers, while asserting that the tariffs have failed to achieve their intended purpose of influencing Chinese behavior.

This plea from the FDRA precedes a crucial meeting between President Biden and Chinese President Xi Jinping, scheduled for November 15. The leaders are expected to engage in discussions regarding the intricate relationship between the US and China.

Section 301 Tariffs on Chinese Footwear Imports

The Section 301 tariffs, implemented in 2019, initially imposed a 15% levy on approximately half of footwear imports from China. This was later reduced to 7.5% in February 2020. However, the industry maintains that these tariffs have exacerbated the existing challenges faced by footwear businesses and consumers.

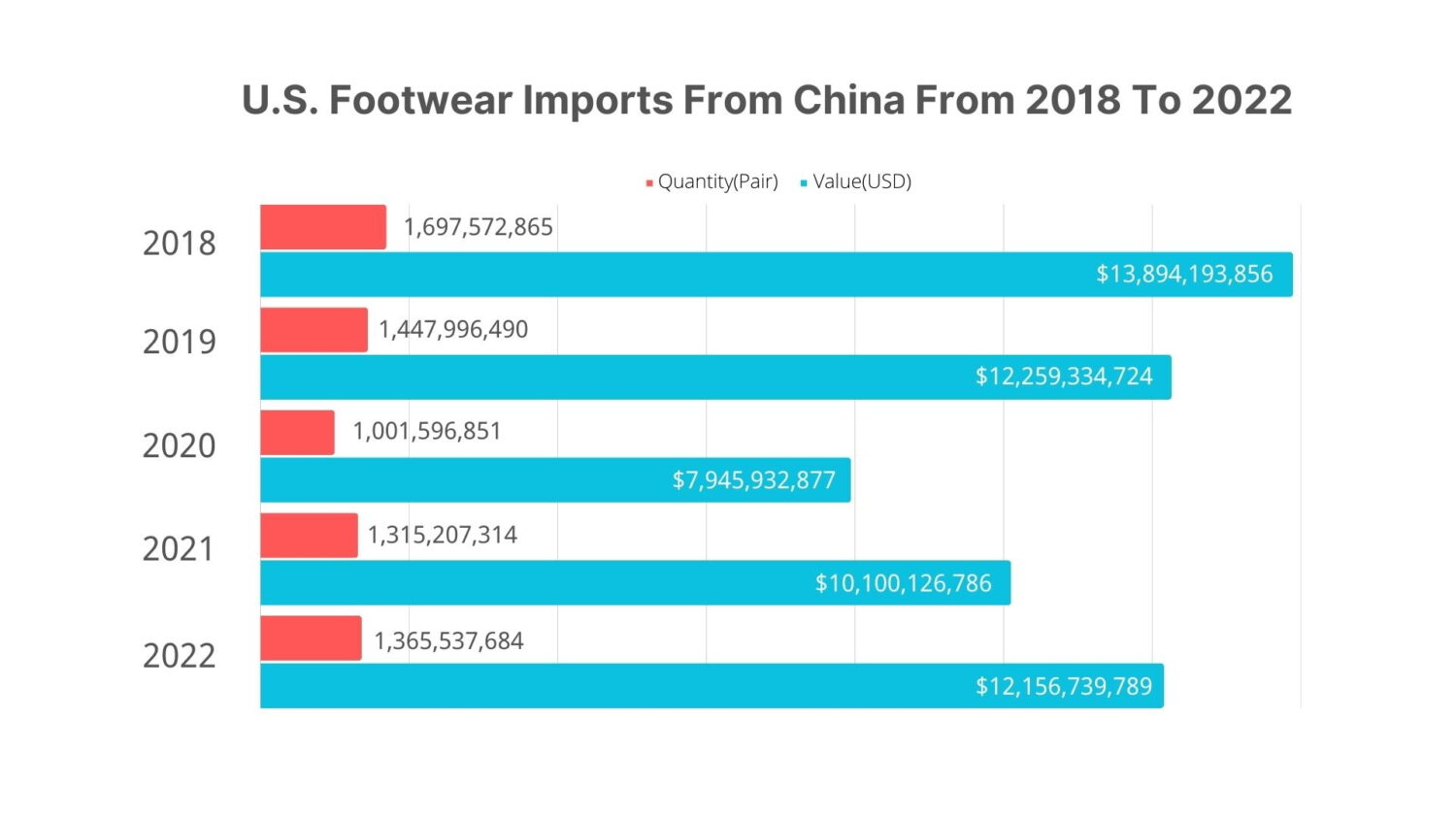

U.S Import Shoes from China (2018 To 2022)

Source: U.S International Trade Administration

Earlier this year, a comprehensive study jointly published by the American Apparel & Footwear Association (AAFA), the National Retail Federation (NRF), The Retail Industry Leaders Association (RILA), and the United States Fashion Industry Association (USFIA) revealed that the Section 301 tariffs have inflicted a “detrimental economic impact” on the US economy.

The report outlined how these tariffs contributed to higher prices for consumers, job losses in the retail industry, and a decline in US exports to China.

The FDRA’s letter highlights the disproportionate impact of Section 301 tariffs on the footwear industry, which is already grappling with high import tariffs from China. The letter underscores that “footwear is taxed at an average rate of 12 percent, while all other imported consumer goods are taxed at an average rate of just 1.9 percent.”

Additionally, it points out that “footwear tariffs reach rates of 37.5 percent, 48 percent, and higher.”

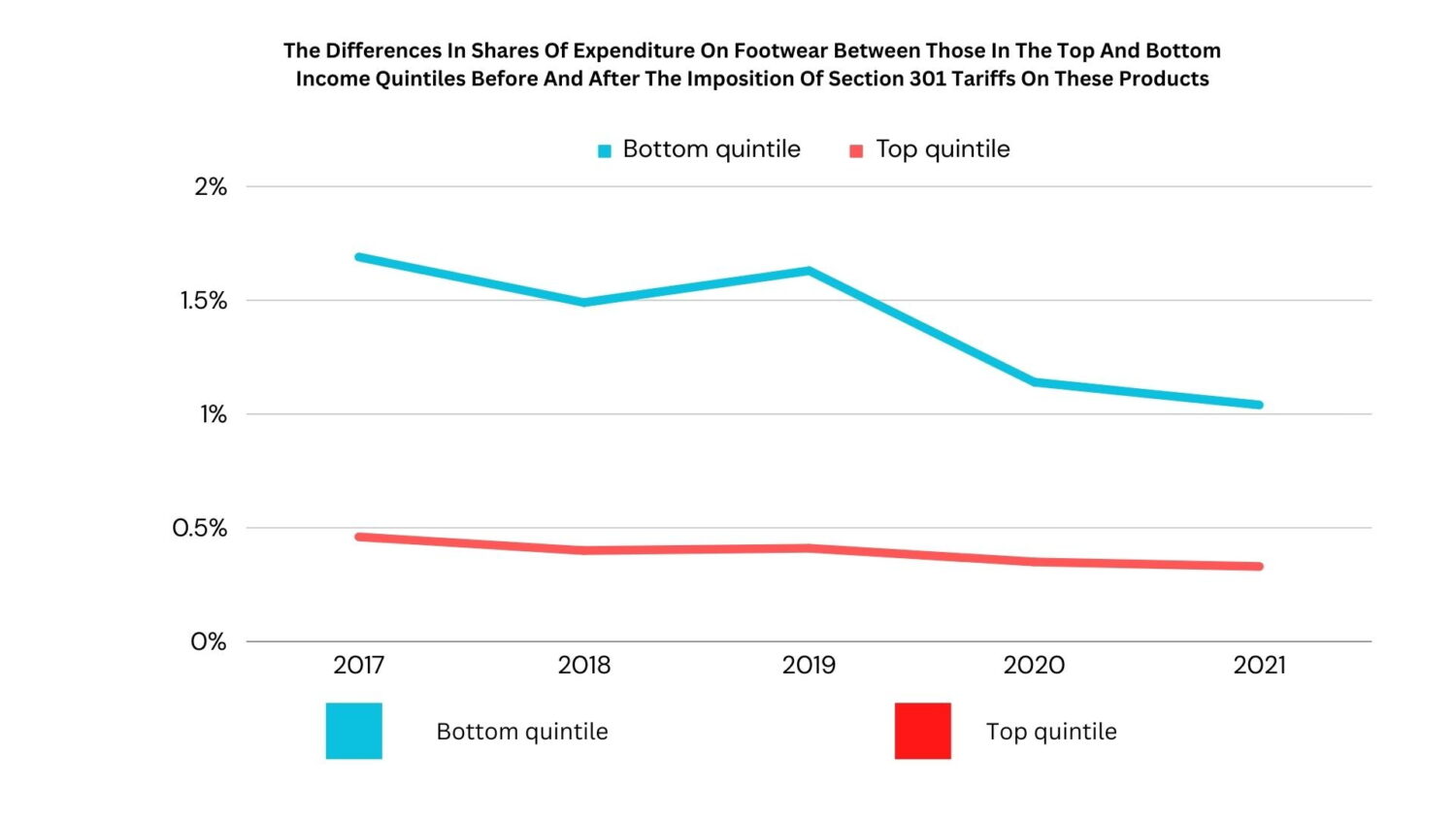

The chart below shows the difference in the share of spending on clothing, footwear, and furniture between the top and bottom income quintiles before and after the imposition of Section 301 tariffs on these products. Section 301 tariffs on Chinese imports hurt American businesses, workers and the American economy, with the poorest suffering the most.

Source: U.S. Bureau of Labor Statistics

Mutual Benefits of Eliminating Tariffs:

The FDRA strongly urges the Biden administration to eliminate the Section 301 Tariffs on Chinese Footwear Imports, emphasizing the potential mutual benefits for both China and the United States. The letter argues that “removing the tariffs would enable footwear businesses to expand their operations, create jobs, and stimulate economic growth” in the United States.

Furthermore, it suggests that “removing the tariffs would reduce footwear costs for American families, allowing them to allocate their budgets more efficiently.”

From China’s perspective, the removal of tariffs signifies an opportunity for increased exports and market share in the United States. With cost-effective production capabilities, Chinesischer Schuhhersteller can potentially capture a larger portion of the U.S. market, fostering increased trade and economic cooperation between the two nations.

Timely and poignant, the FDRA’s letter serves as a compelling call to action for the Biden administration. The plea emphasizes that the existing tariffs on footwear impose a burden on American businesses and consumers, with little impact on influencing Chinese behavior.

The FDRA urges the Biden administration to promptly remove these tariffs to foster a more conducive economic environment and promote mutually beneficial trade relations between the United States and China.

Voices from American Business Leaders:

Denis Ball, a prominent figure in the shoe business, applauds the move, stating, “Excellent timing and best of luck. This is nothing more than a TAX on low to middle-income Americans and should be removed immediately.”

David Ford shares a similar sentiment, expressing, “Tariffs have, are and always will be a tax on the poor. There are better ways to support domestic industries. Let’s face it, none of the revenue from these so-called protections is actually spent on supporting the domestic industry. Time for progressive change.”

Aaron Altman, another key player in the industry, appreciates the efforts, adding, “Many thanks. Please keep pushing! However, I’m sure the US gov’t needs every possible revenue stream available. Just think about the annual revenue generated from every Air Jordan?We all know that the US customer pays the tab. It’s a hidden tax that the customer knows nothing about, yet we all know the real story.”